FinCrime CDD Intelligence: AI-Powered Customer Due Diligence

FinCrime CDD Intelligence: AI-Powered Customer Due Diligence

Enterprise-Grade Financial Crime Prevention Platform

[🤖 AI-POWERED] • [⚖️ RISK ASSESSMENT] • [🔒 SECURE]

🧠 LLM-Enhanced • 📋 Document Validation • ☁️ Multi-Cloud

Empower financial institutions with intelligent, secure CDD

Why FinCrime CDD Intelligence?

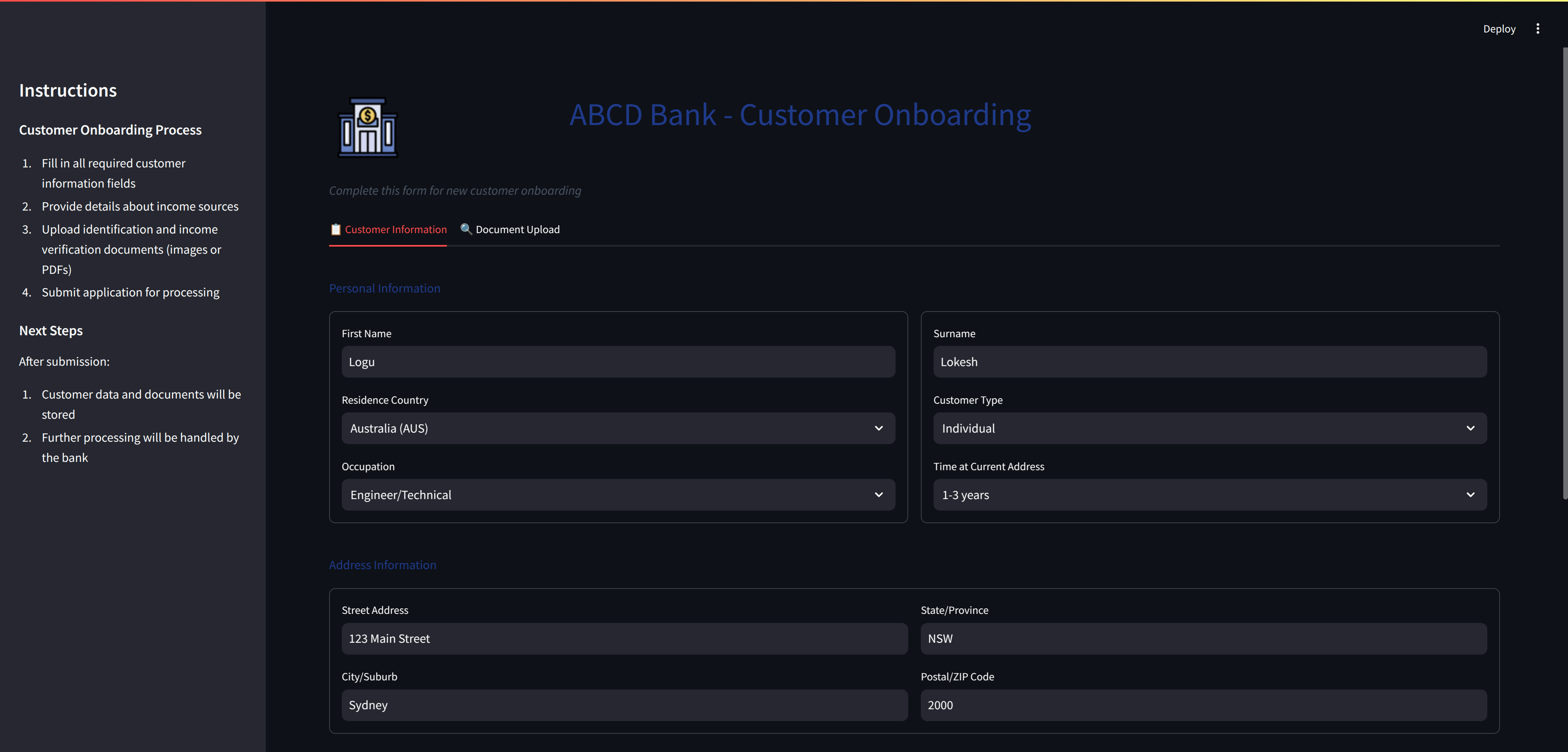

FinCrime CDD Intelligence is an enterprise-grade platform for financial institutions, combining AI/ML with regulatory compliance for seamless customer onboarding and risk assessment. Powered by Streamlit, XGBoost, and LLMs via Ollama, it automates document validation and delivers precise risk scoring, deployable across AWS, Azure, and GCP.

Key Features

- 🧑💼 Customer Onboarding: Collects data and validates documents using AI (llava:7b).

- 📈 CDD Risk Scoring: Combines XGBoost and LLM (granite3.2) for structured and unstructured risk analysis.

- 📄 Document Validation: Identifies passports, IDs, and income proofs with high accuracy.

- ⚖️ Risk Categorization: Classifies customers as low, medium, or high risk in real-time.

- ☁️ Multi-Cloud Support: Deploys on AWS, Azure, and GCP with Kubernetes orchestration.

- 🔒 Secure Design: Uses SQLite locally, with enterprise options for encrypted cloud storage.

Security by Design

FinCrime CDD Intelligence ensures enterprise-grade security with AES-256 encryption, TLS 1.3 for data in transit, and comprehensive audit logging. It supports SOC 2, PCI DSS, and GDPR compliance, with multi-cloud redundancy for 99.99% availability.

Integration with KinAI Ecosystem

While a standalone solution, FinCrime CDD Intelligence can integrate with the KinAI Ecosystem, sharing risk insights via a secure chat hub for responses like: “High-risk customer detected; manual review required.” It complements KinAI-Vision, CareVault, NexPatrol, Mentor, and GeoPulse.

Get Started

Explore FinCrime CDD Intelligence on GitHub for setup guides, code, and documentation. Strengthen your financial crime prevention today!

Visit FinCrime CDD Intelligence on GitHub

Built with ❤️ for security, intelligence, and compliance.